We use cookies to improve your experience and measure site performance. By using our site, you agree that we may do so as outlined in our Privacy Policy and CA Privacy Notice.

You have been redirected to the main content area of the page.

Ages 7+

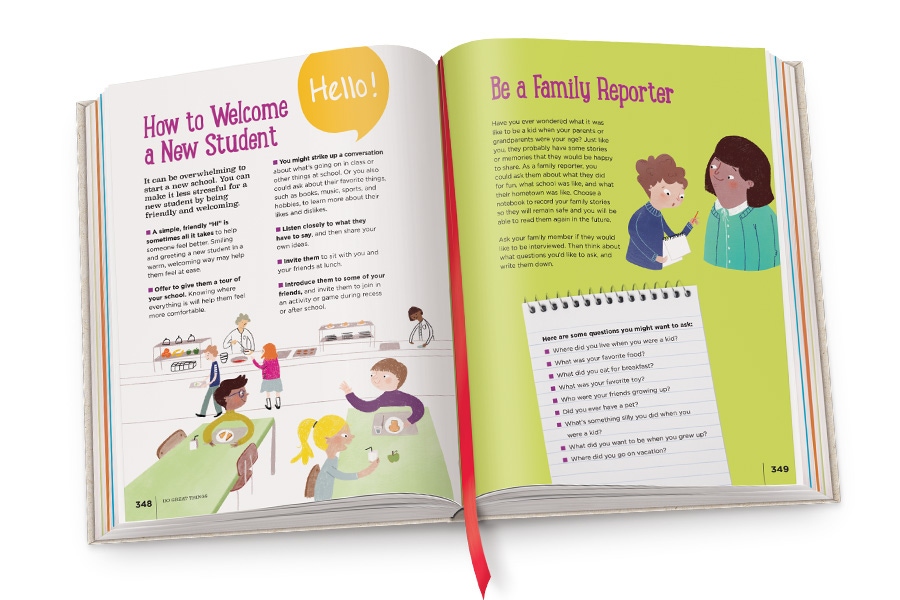

The Highlights Book of Things to Do

Limited Time | 20% OFF

$23.99+S&H 20% off: $29.99

Banish boredom with hundreds of fun things to do! This award-winning activity book is filled with over 500 tech-free ideas for experiments, crafts, games, recipes and more activities that will inspire curiosity and spark creativity in kids ages 7+.

SKU #A7642

Available for U.S. Shipping Only

Our Guarantee

Your satisfaction is 100% guaranteed. You may return any shipment and owe nothing. If you wish to cancel an order or stop a shipment, just give us a call.